A Guide to Using YNAB to Support NDIS Self-Managed Budgeting

As a self-managed user of Australia’s National Disability Insurance Scheme (NDIS) it is necessary to budget, account for, and forecast expenditure over the 12-month period of the funding agreement.

The typical way to do this budgeting would be with a spreadsheet, laid out in the typical fashion with columns of months and rows of accounts. This is how I assumed I would do it. Yet as I got stuck into the job of building my spreadsheet I realised how much I no longer enjoy working in spreadsheets.

My feelings for Excel

My feelings for Excel

For a period of my early career, Excel was life. But that was a different time, and a different me. I ain’t got no time for Excel now. I’m over it.

Leveraging Ynab

What I do have is a subscription to YNAB which happens to be the most effective personal budgeting tool I have ever used.

I thought it would be worthwhile to see if I could extract more value from my YNAB subscription by creating a budget specifically for managing NDIS expenditure.

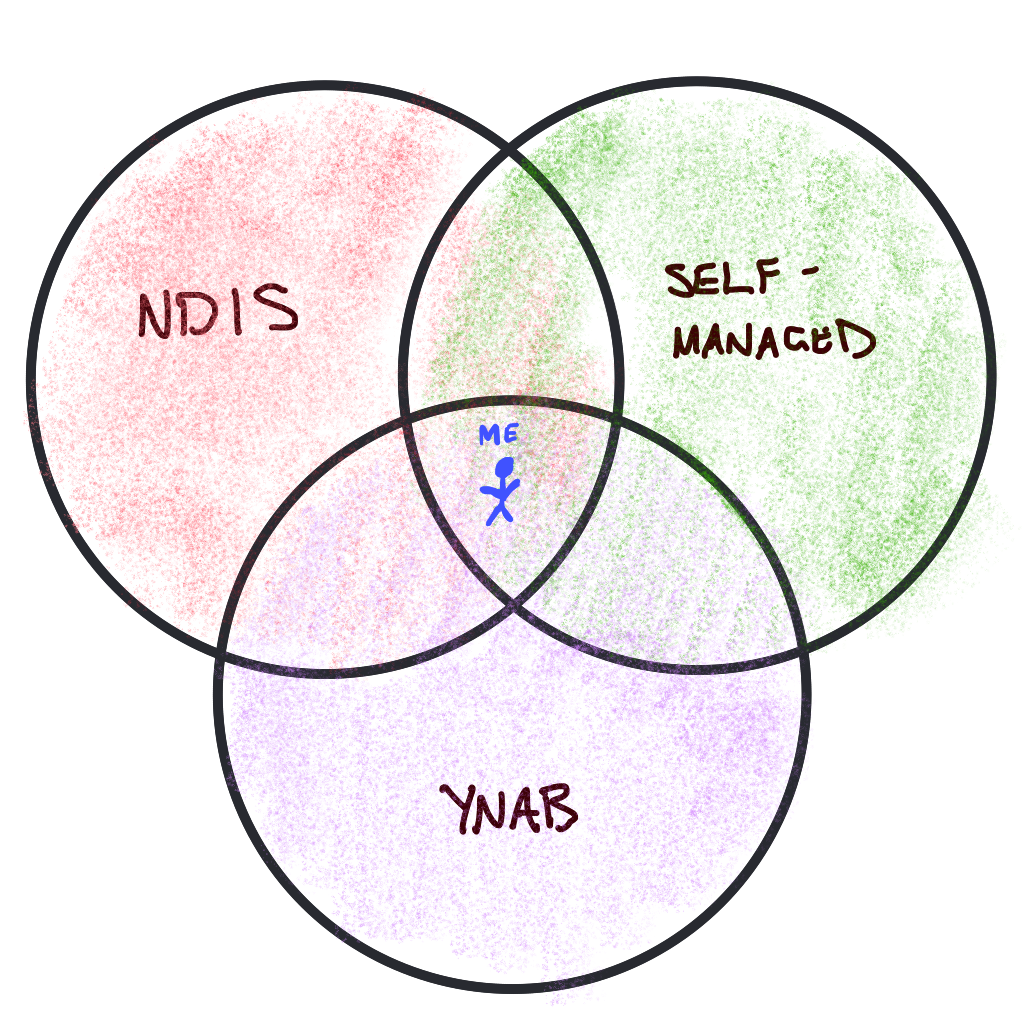

My Venn Diagram

My Venn Diagram

This is a niche solution for a niche problem. The Venn Diagram of people who are self-managed participants of the NDIS and use YNAB must be vanishingly small. But perhaps, one of those people might stumble across this post and find it helpful.

Build the Framework

The following is a guide explaining how YNAB can be configured to support the budgeting and accounting tasks associated with a self-managed NDIS plan.

- Create a new YNAB budget file specifically for NDIS budgeting and expenditure.

- Within that budget, create

Category Groupsto match relevant NDIS funding descriptors. - Within the Category Groups built at Step 2, create

Categoriesfor each service provider expected to be used through the life of the NDIS Plan.[^Remember that more providers can be added later, if necessary, so no pressure to get this completely accurate at the start.] - Create

On-Budget Accountsfor each of the relevant NDIS support budgets.[^There are three potential budgets: core budget, capacity building budget, and capital budget.] The NDIS requires that funding be expended for the purpose it is granted, so the creation of specific accounts prevents leakage across allocations. - Inflow the funding received from the NDIS for each support budget into its associated YNAB account. This will become the starting balance from which to budget for the year.

Well done, your YNAB framework is ready!

Establish and Run the Budget

Now, you can build your budget using the standard YNAB approach of giving each dollar a job, but in the context of NDIS expenditure.

Based on quotes, service agreements and your own preference, allocate your total NDIS budget value across your service providers. Ensure that the subtotal for each Category Group matches the sum allocated to its YNAB account.

As services are delivered and invoices paid, input them as expenses within the relevant account (Core Supports/Capacity Building/Capital), assigning the supplier as the YNAB Payee, and the Category as the relevant provider you created as a Category. This is hard to explain, but easy to do.

For bonus points, you can choose to highlight the cleared icon once a rebate is received from the NDIS back into your transaction account.

The Result

Following these steps will leave you in the enviable position of having up-to-date figures that can readily display:

- overall expenditure

- expenditure per NDIS budget group

- funds remaining per NDIS budget group

- budget allocations per service provider, but with the added ability to dynamically rebalance your budget using YNAB’s built-in

move moneyfeature - as long as you only move it within YNAB’s Category Groups to maintain the integrity of the NDIS support budget allocations.

You also gain full access to the YNAB reports to more deeply analyse your expenditure should you wish.

Notes

- Remember, this is not a budget for your bank account. If you make payments and/or receive reimbursements the bank accounts transactions are not specifically recorded in this YNAB budget. Use your everyday YNAB budget for that.

- The YNAB system relies on maintaining the

To Be Budgetedfigure at $0.00. Keep it at this and you will not go over budget.