The boy received a Nintendo Switch for Christmas. Dad approves of Super Mario Odyssey.

The boy received a Nintendo Switch for Christmas. Dad approves of Super Mario Odyssey.

Boxing Day in Western Australia and it’s overcast and not hot. What an outrage. I want my money back.

Merry Christmas micro.blog friends!

10:30am. Already tuckered out.

This is frightening. Even should the tower be declared safe (and I don’t think it will be) who would live in it now? Sydney Opal Tower apartment building evacuated after reports of cracking noises - ABC News

I’ve been an Overcast user since it launched, but feeling a little bored by it. Wondering if Castro might be worth a try. Do people have thoughts?

Living the holiday dream.

Onward!

Not a bad place to be.

I miss playing basketball 🏀. I was good at it and now I’m just old and decrepit.

I’m getting itchy to restructure my web properties. Trying to sort out how best to use my website, Wordpress blog, Blot blog and Micro.blog in a way that makes sense and plays to each of their strengths.

V8day

V8day

It’s difficult to be a fast driver when it’s been a decade since the last time you’ve driven a manual transmission car.

That’s my excuse and I’m sticking with it.

Our family recently travelled to Bali for a holiday break. It was a week of relaxation at the tail end of a year that has been pretty crazy, and a 2019 that we expect will be even more hectic.

When you travel with kids, conversations can move in varied and interesting directions. Our 7-year old boy took a particular interest in the toilets that were installed throughout the hotel we were staying. The brand — TOTO — is one seen all over the world, but less so in Australia. He was enthralled by the features: from automatic flushing with infrared sensors, to in-built bidets. Even the design of the loos was novel to him. He was fascinated. Next he realised that TOTO had also been responsible for the all of the tapware as well. Incredible!

As a responsible Dad, I kept the toilet banter going, egging him on to explain to me further what he loved about them. I tried to add some interesting educational angles as well. I suggested that as a Japanese company, TOTO probably took great care in their manufacturing processes. I explained how Japan was the cradle of modern manufacturing methods, and how the Toyota Production System changed the world. I’m not sure he bought into my lesson on lean thinking, though. I will have to try again in the future.

Over the length of our stay, our conversations escalated to the point where I suggested we contact TOTO directly to let them know what great work they were doing with their toilet design. He took to that idea! So we did it. My son wrote an email to TOTO Customer Service, noting how impressed he was with their toilets, and expressing his desire to have them installed in our house as well.

I figured that would be the end of it. I didn’t expect to hear back, or if we did, I assumed it would be a boilerplate response. After a few days, we did in fact receive a reply, and it was a wonderful, personal email from TOTO’s Senior Manager of Customer Service. In the email, she expressed gratitude for my son’s kind words, and also offered to send him some tokens of appreciation if we could provide our mailing details.

We replied, and for fun, included a photo of David and I enjoying ourselves in Bali.

A few more conversational emails bounced back and forth between TOTO and ourselves, and they asked if we could send a photo of David with his items once they arrived.

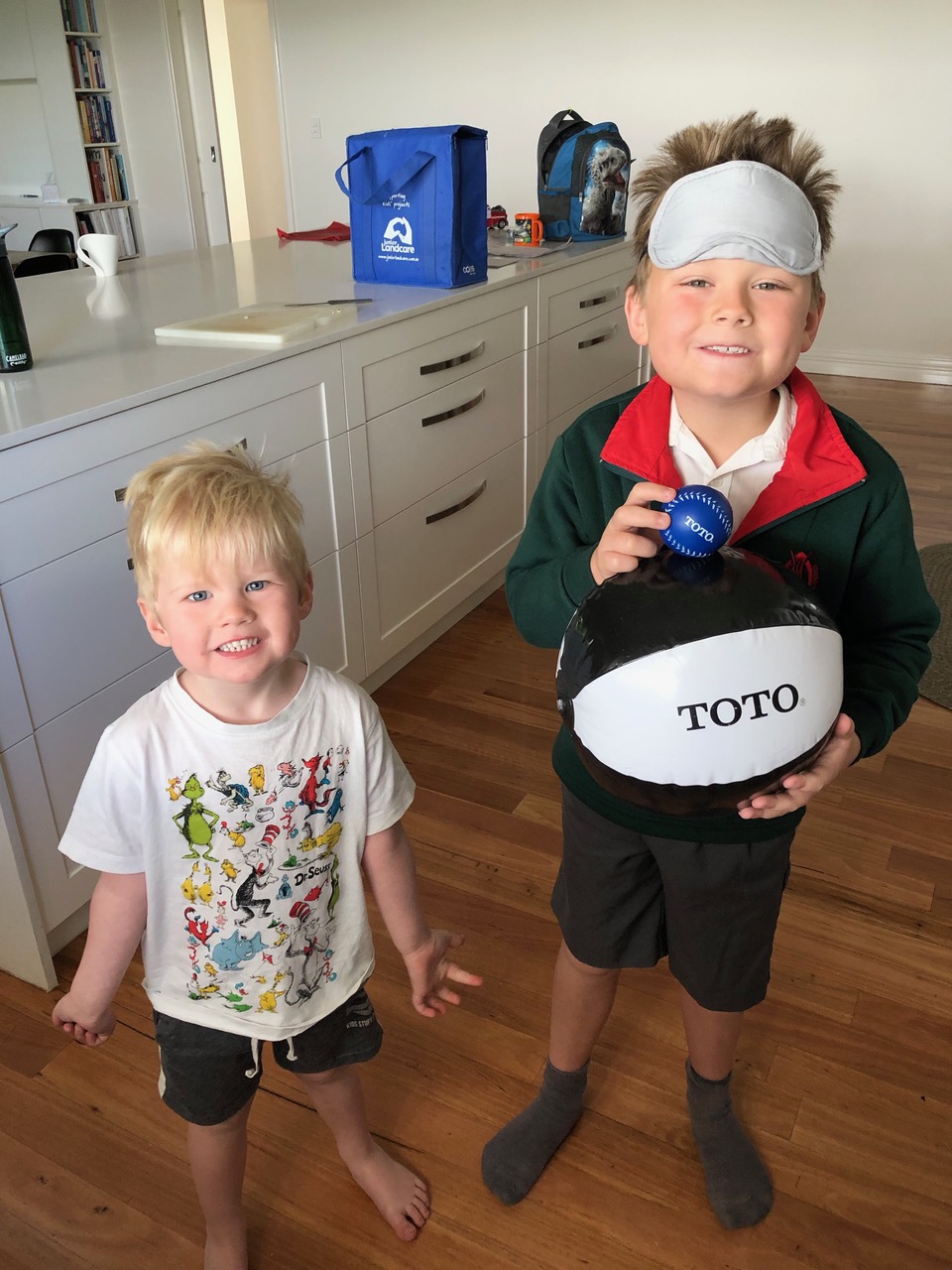

Within the next few week, we received an express mailed package from TOTO in Atlanta, to us in Perth, Australia. Just this concept alone was enough to blow my son’s mind. As promised, we sent another photo back with David holding onto the gifts he had been sent, and this was acknowledged by TOTO with thanks.

I see two key lessons in all of this:

So thanks TOTO, for bringing fun and joy to me and my son’s lives, and for making sure this particular Bali holiday will have a very strange and unique anchor memory.

With the help of Be Focused I cranked out the Pomodoro sessions today. Achieved everything I wanted to, and more. It’s satisfying to end the day with a high productivity quotient.

Best Santa ever.

I’m experimenting to see if I can eliminate my use of Bear, moving its notes into DEVONthink Pro. This would save me a subscription charge and lessen the “within which app did I save that information?” problem.

I would love for one of my micro.blog followers to take advantage of my Backblaze coupon. You get a month free. I’ve been a happy customer for a couple of years now.

Trevor Noah is one funny man. His “Son of Patricia” show on Netflix is great.

I’ve done my bit for quality journalism: I bought an annual subscription to Crikey plus their bonus offering at the moment: 3-month subscriptions to The Monthly and The Saturday Paper.