I tried to use the micro.blog markdown importer. I got a success message, but after about 10 minutes there is still no evidence of any of the posts on my micro.blog posts page. Is there something I missed? @help

I tried to use the micro.blog markdown importer. I got a success message, but after about 10 minutes there is still no evidence of any of the posts on my micro.blog posts page. Is there something I missed? @help

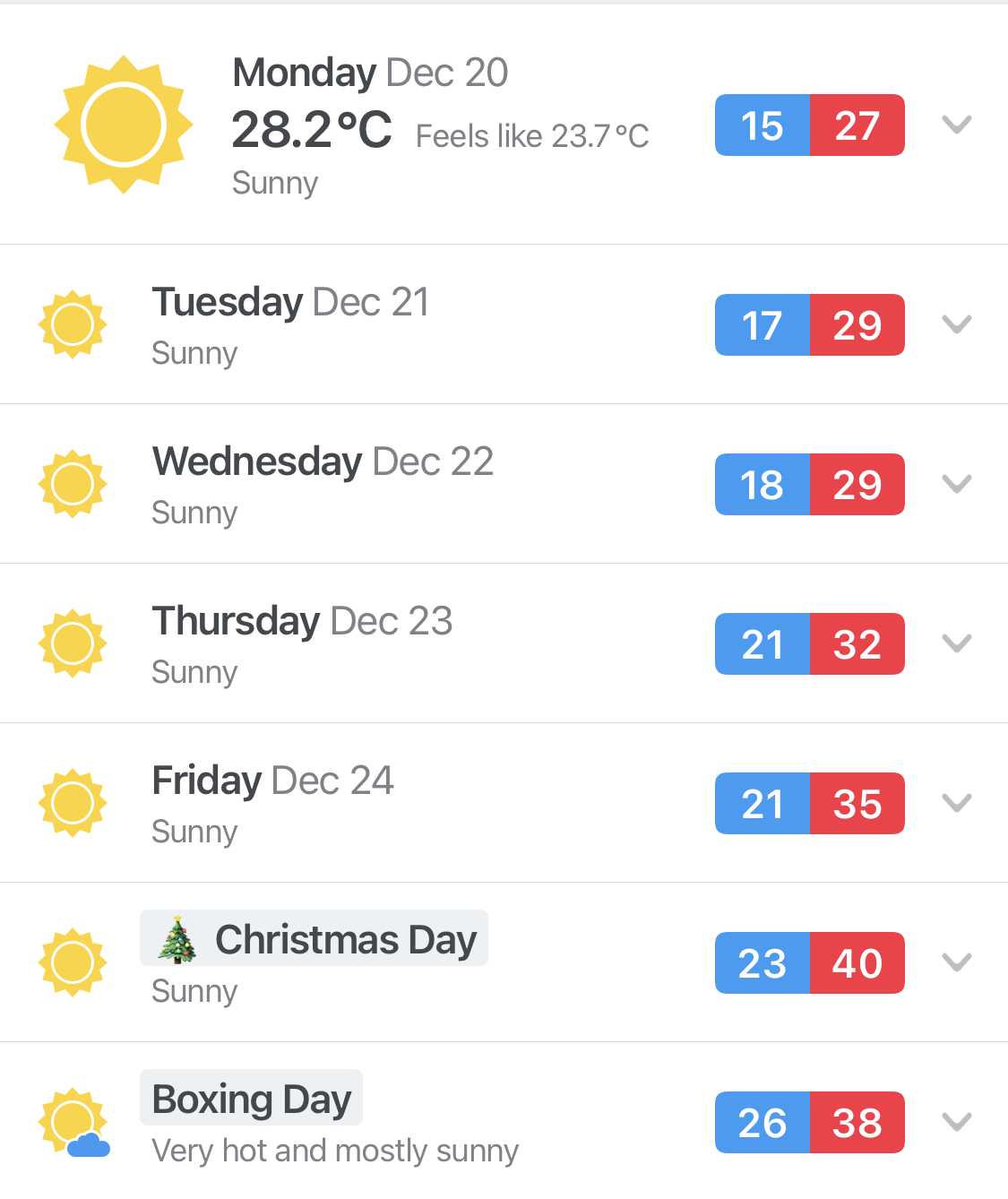

These last two days in Perth have broken records for heat. Both Christmas Day and Boxing Day were several degrees over 40ºC. I am immensely thankful that this year, for the first time in my home ownership history, we have a swimming pool. With weather like this, it’s a complete game changer. A benefit of the heat is that upon emerging from the pool, it takes only minutes to be completely dry from the hot air. At which point you are warmed up enough to want to get back in.

I’ve previously explained on Hemispheric Views Episode 032: It’ll Blow the Roof Off Your House! that our house has evaporative - not refrigerated - air conditioning. On dry heat days like we’ve had, it’s worked well. It keeps the house pleasantly cool.

So, despite these two days setting December heat records for Perth, I’ve felt more cool than I have in previous years.

Tomorrow, the forecast is for a mild 39ºC.

Added another 2 years of subscription for canion.omg.lol. Best value profile provider on the internet.

I’m contemplating migrating my Blot site to micro.blog - and having a single site to rule them all. Should I do it?

What a waste of an opportunity.

Watched on Friday December 24, 2021.

Merry Christmas! 🎄

Finished reading: Ball Boy by Paul Shirley 📚I’m afraid I didn’t love it.

Dealing with a kid that has autism can be trying. 😞

For Benji’s birthday we went to the cinema to see Spider-Man: No Way Home. The boy has been obsessed with Spidey for about the past four years so he was beyond excited. 🎥🍿🕸🎂

Benji was really feeling the Christmas spirit in this one. 😂

It was great to get out of the house today. I read some of my book, and had a FaceTime call with @burk.

My bike has been professionally serviced. Once again, I have no excuse not to ride.

While @maique is looking forward to a wet and windy Christmas, I’m looking at this:

A year ago today I received my MacBook Air M1. It doesn’t feel I’ve owned it for a year; it still seems brand new in my mind.

For the end of 2020 I wrote a retrospective looking at the main events and happenings of the year, broken down by month.

I figured it would fun to do the same thing again for 2021. I didn’t take copious notes over the course of the year, so I’m piecing this list together from calendar notes.

Reflecting on these notes for 2021, my life had few highlights. Most of the time was taken with household management and caring for our young kids. There’s not much to look back on that was fun or exciting, and that’s probably why I have struggled a bit with my mental health this year. With no tentpole events through the year, it became a grind of sameness.

Next year I need to be better at identifying and taking action around doing some things that are for me.

If I’m particularly brave, I should review my career path as well, because that has stagnated. I’m probably due for a new challenge, or else my mind may risk atrophy.

Update: 14 December 2021:

John, a kind reader of this blog emailed me to correct the record regarding the age of these apps. I imply below that Quicksilver predated Launchbar when in fact Launchbar is the oldest of the crop. In my usage, Quicksilver was the first King - it was my gateway drug to this application category. But Quicksilver was not the first.

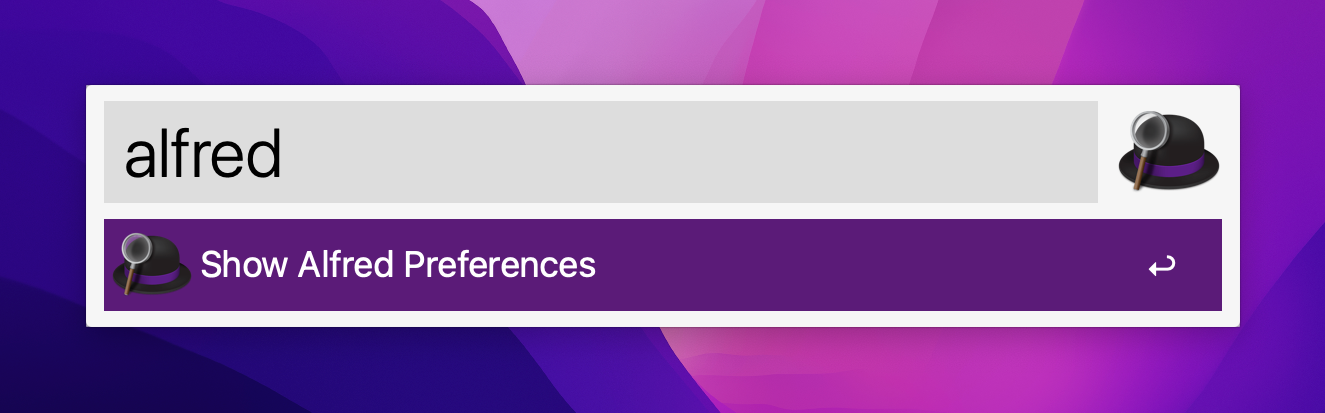

A few days ago I noticed that Launchbar was consuming excessive CPU cycles on my iMac. I quit the app and relaunched. Same thing. I rebooted my Mac. Same thing.

That was the straw that broke the camel’s back.

I went to the website of Alfred, downloaded the app and purchased the Powerpack immediately.

After perhaps a decade(?) of daily use I was over Launchbar. For the last few years it had seen very little development. The developer was showing it no love - no blog posts, no forums or user community, and its attempt to copy the Alfred ‘workflows’ feature had fallen flatter than a pancake. Now, I couldn’t even rely on it being an efficient system application.

So I threw my years of muscle memory in the bin, and I’m working with Alfred from this point forward. It’s different - and I’ve had to tweak a few settings to align with my view as to how an app launcher should work - but it’s working. The main adjustment I had to make was to allow for arrow keys to traverse the file structure.

My main frustration is that it doesn’t seem to automatically include files and folders in the default search when the trigger keys are depressed. Instead I have to type a space to enter into file search mode. I see in the preferences that you can include these in the default search, but the app includes text that seems to be warning me off doing that.

It also doesn’t have the instant-send feature of Launchbar. While that was neat, I didn’t use it so often that I desperate miss it. It was a nicety, but I can live without it.

What I can report about Alfred is that it works without fuss. It is currently using 0.2% of CPU time. It lets me search and act on files. It is fast.

Launchbar has been the reigning King since it took crown from Quicksilver. It has now passed the throne to Alfred. Long may it reign.

This post was originally written in July 2021 for Hemispheric News; subscribe at the Patreon site One Prime Plus to receive this monthly newsletter and other benefits that are linked to the Hemispheric Views podcast.

I am a father of two boys. One is 9 (almost 10!) and the other is 5 ½. I work in a fairly flexible capacity whereas my wife has a highly demanding job that has significant variability. Our time as a family is precious, but sometimes difficult to co-ordinate. So when we do have good quality time together, we want to make it count.

It’s a challenge to find things to do with as a family that meets all the necessary criteria:

You might think this would be easy. You might have lovely ideas of joyous, considerate play. No. And no.

This is (to coin an Australianism) bloody hard.

While the easy answer is electronic, iPads, Nintendo Switch, Netflix, this isn’t necessarily the most appropriate answer. I do have a need to find entertainment that incorporate activity and engagement with all the family members.

An extra challenge to throw into the mix is that my eldest has autism. This can make him cantankerous and difficult to get to engage in things that he hasn’t done before or that he doesn’t have confidence in his own ability to do (well, immediately).

Recently we have gone to a couple of old classics, and some newer classics. We have played some rounds of Uno. The great thing about this is that our 5 year old can play - and sometimes win - with no skill required. He knows colours and numbers and can understand the concept of matching. Sure, Draw Two and Reverse are beyond him, but that’s okay with a bit of parental support.

We’ve also played Skip-Bo. To be fair, Hannah and I have enjoyed this more than the kids.

Other board games have included Settlers of Catan (Junior) and Cards Against Humanity (Family Edition), and Clue-Do (Harry Potter Edition).

Co-host Jason Burk has also suggested Society of Curiosities. This I am yet to try, but I am keen to give it a go.

Can you recommend any entertainment options that might suit my family and get them away from their screens for a while longer? I’d appreciate your suggestions. Fire them back to me via the Discord so that others can benefit too! In no time at all, Martin will be having these sort of challenges with Mac. He’s a baby now, but that won’t last long!

It’s cool to see your own feature request that you’ve been beta testing forked into the main build. Thanks BusyCal team!

When dragging tasks from OmniFocus to create events, BusyCal now applies the duration (if any) to the event too.

Either I’m an old man who is shaking his fist at the clouds, or I’m a rational person that isn’t easily bedazzled and deluded by the madness of crowds. I prefer to think I’m the latter. Crypto has captivated the masses, and delivered opportunity to the financial grifters who portray themselves as disciples of a new financial world order.

I may be missing out on ‘easy wins’, trading cryptocurrencies - buying low, selling high. What I know for certain, however, is that I’m missing the opportunity to be the last one holding the hot potato when the music stops and the entire Ponzi scheme comes crashing down.

Wherever there is fervour, I see risk. Where a financial instrument is deigned by “experts” to be capable of changing the world, I see a snake oil salesman wanting to offload empty promises at my expense.

To my mind, a crypto asset has no inherent value beyond the hope that somebody thinks it will be worth more, and so will be willing to pay more, so they can on-sell to the next chump who thinks it will also go up. That’s not a good recipe for sound investing. That’s gambling. Crypto itself has no underlying value. It’s not a commodity with underlying value. It has no intrinsic productive value.

A few days ago I attended the West Tech Fest conference in Perth, and a huge chunk of the day was dedicated to speakers excitedly talking up crypto, memecoins, and other such “financial instruments”. One person was explaining that the younger (current?) generation are more financially aware with a higher tolerance for financial volatility, and therefore willing to ‘take the risks’. I’m calling bollocks on all of this. Of course, these statements were also made by an industry insider - a representative of a business that offers a platform for trading crypto. Now why would they be encouraging profligate “investment” in ridiculous products with no underlying value? As always, this is where I turn to my man, Lester Freamon.

If you’re not convinced that crypto is simply an energy-sapping, hype offering that isn’t going to deliver any of the amazing things it’s zealots say it will, I encourage you to undertake some further reading, and apply some rational economic thought.

We’ve seen bubbles before. They always work the same way. Sure, some people get rich. Some do okay. But many are hurt, and left holding an, ahem, “asset” that isn’t worth jack. Just because this is a digital item riding the Web3 hype train doesn’t mean it’s going to end any differently.

I suggest you read the brilliant work of Stephen Diehl. He has published a number of excellent, considered articles on this topic. Read his work, follow the links and maintain an open mind.

There are a number of great quotes in his articles; below I’ve extracted just a few of my favourites. Everything Stephen writes is so good though, I encourage you to follow the links and read the full articles.

Memecoins are pure greater fool investments, they’re basically a hot potato that people trade hoping to offload it on someone dumber than them who will pay more for it. And the implicit assumption behind the terminal value of these assets is that there’s an infinite chain of fools who will keep doing this forever. Nassim Taleb deconstructed this concept from a quantitative finance perspective in his whitepaper but nevertheless these assets persist because people behave economically irrationally and like lighting money on fire and dumping it into memes regardless of financial sanity. Meme coins like dogecoin exist simply for people to gamble on a fantasy about talking dogs, and bitcoin is a meme token for gambling on a fantasy about living in a cyberpunk dystopia. At the end of the day, memecoins are not that economically distinguishable from Ponzi schemes.1

After twelve years of these technologies existing (roughly the same age as the iPhone) there is basically only one type of successful crypto business: exchanges which exist to trade more crypto. 1

Unlike a gallon of petrol which can be burned for energy, or a kilo of wheat which can be made into bread, or a[n] ounce of gold which can made into jewelery, there is no intrinsic use of a bitcoin. There is nothing inside of a bitcoin that can be used for anything other than to offload it on someone else who will buy it for more than what you paid for it. It is nothing more than a pure greater fool-seeking asset.2

Crypto assets are the synthesis of a speculative mania and a financial scam built around an opaque technology, phoney populism, with a tolerance for intellectual incoherence at its core. And it is a novel type of a scam, one that we don’t have a precise term of art for. They share the obscured and circular payouts of Ponzi schemes, the cult-like recruiting of multilevel marketing schemes, the ephemeral nature of high-yield investment fraud, and payout mechanics of pyramid schemes but strictly speaking they aren’t exactly like any of the classical scams. 2